WM’s TUV Digital Currency is already a tested, proven, due diligenced, refined and fully operational Global CBDC-equivalent for all currencies. It can be seamlessly adopted and used by any entities worldwide with immediate effect

An example of globally-functional TUV Digital Currencies for countries that are still trying to create a globally-functional CBDC

ST PETER PORT, Guernsey and NEW YORK, Oct. 14, 2021 (GLOBE NEWSWIRE) — Global Telephony Provider Webtel.mobi’s 21st Century replica of the existing Global Financial System follows the same structure to ensure proper control.

It differs only in:

- The Components – which have been optimized to 21st Century standards and capacities. These increase security, decrease transaction times, remove unnecessary intermediaries, lower, or remove all costs, and function 24/7/365 instead of 24/5/365.

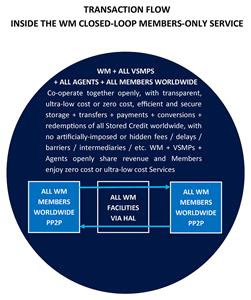

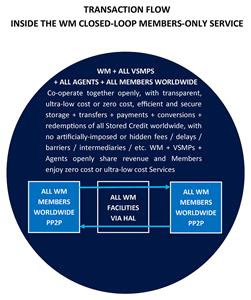

- The Transaction Flows – in that WM’s Global Financial System replica enables Pure Peer-to-Peer (“PP2P”) Transactions between all Members.

- The Management and Supervision – in that WM’s Artificial Intelligence Complex Adaptive System (known within WM as “HAL”), and WM’s Global VSMP and Agent complement, are jointly able to exercise better and closer management and supervision of all transactions than the current system

- The Running Costs / Operational Costs – which for the current Global Financial System are in the very high USD Trillions, and for WM are multiple factors lower in cost.

- The standard of Anti Money Laundering – in the current system, there are tens of thousands of entry points (Bank Branches Worldwide) and tens of thousands of destinations (Bank Branches Worldwide) – for tens of millions of potential routings and combination. This makes it virtually impossible to detect all so-called “layering” techniques for Money Laundering. In the WM System there is only one entry point and one exit point, with every transaction able to be monitored from cradle to grave. There is zero possibility for so-called “layering” to take place.

A Comparison between the Structure and Flow of the Current Global Financial System and the Structure of WM’s Global Financial System

The WM System has been robustly checked. Reviewed, due diligenced and optimized over nine years of full operational testing, and none of its attributes are theoretical or aspired to. They are all proven, due diligenced and fully-operational worldwide – and have been for some time.

Although the WM System is set for PP2P transactions between all its (and its VSMPs’) Members worldwide, WM’s Complex Adaptive System is structured in a Modular format, and it facilitates any variation of the Transaction Flows within the System.

As an example, WM already has what are known as “Restricted VSMPs” and/or “Closed and Restricted VSMPs”. These enables organizations – at any level, and with any number of their own sub-entities and clients – to have a VSMP, or multiple (hundreds) of VSMPs, structured for them that only allow their own entities, sub-entities, and clients to enter and use among themselves.

An Illustration of the Transaction Flows in the WM Global Financial System

Moreover, WM’s VSMPs – or VSMP chains, can also be electively set to be segmentalized by country, by region, by currency and/or by other delineators. It can also be electively set to mandate transfers, currency conversions or swaps or other transactions to only be done through designated VSMPs.

In other words, it can be set to exactly replicate the transaction Flows of the current Global Financial System – just without the tens-of-thousands of intermediary organizations required for the current Global Financial System to function.

WM’s TUV Digital Currency is also fully functional in, and for, every currency, and already has all the (proposed) characteristics of Wholesale and Retail CBDCs. It also has a vastly higher number of characteristics that have not yet been identified as absolute requirements – which they are – for a functioning Global, Secure, Distributable, Accessible, Transferable, Convertible, and Redeemable CBDC.

WM also has the fully operational Global Exchange Mechanism – required for any contemplated shift to a Global Digital Economy based upon Global Digital Currency.

If adopted for use by current entities within the Global Financial System, these enable various long sought-after results to be immediately acquired and achieved, with no further cost or time utilization. Among other results, instant achievements include:

- A fully-functional and fit-for purpose Global CBDC-equivalent in, and for, any currencies.

- A Global Cashless society (in a benign manner)

- Fusion of the advantages of Digital Money and Cash Money – with negative aspects of each removed (WM’s TUV Digital Currency).

- Inclusion of all Unbanked Persons worldwide into a Global Digital Economy.

- A lower cost – a more rapid and more secure alternative to the SWIFT System.

- A lower-cost, instant and more stable PvP and RTGS alternative to the current Global FX Market.

- A lower-cost and more secure alternative to many transaction types (WM’s “Smart TUV”).

- A fully functional International Clearing Union / Global Clearing System (the WM System).

- Increased Security, Eradication of the “layering” potential for Money Laundering, greater AML capacities, lower transaction costs, faster transaction speeds, real-time administration and record-keeping, higher and greater security, 24/7/365 functionality and removal of systemic stress for PvP and RTGS settlements.

Furthermore, WM’s System is specifically configured to enable existing entities within the current Global Financial System to begin to utilize it immediately – if they wish to.

Whether it be for immediate utilization of CBDC-equivalent Global Digital Currency in their own currency, setting up their own Banks + Branches + Clients in a Closed and Restricted VSMP Stream, or anything else that is part of the current Financial System’s structure – it already exists within the WM System. It can therefore be structured or implemented for any party, on demand.

Therefore, there is no rational requirement to continue with any more years of research and discussion on aspirational attempts at CBDC-creation at the cost of more years of wasted time and more multi-Billion or Trillions of wasted Dollars.

This is because – that which is being aspired to already exists, as a fully-operational worldwide reality.

Resources:

Media Contact:

Nick Lambert: wm@thoburns.com

Characteristics of WM’s TUV Digital Currency:

https://webtel.mobi/info/tuv-characteristics/

WM’s “Smart TUV” Digital Currency:

https://webtel.mobi/info/my-smart-tuvs/

WM’s “Secured TUV” Digital Currency:

https://webtel.mobi/info/my-secured-tuvs/

WM’s “Closed and Restricted” VSMPs: (Pages 248 and 249)

https://webtel.mobi/media/info/telmobi-group-vsmp-handbook.pdf

Research Reports on the Capacities of the WM System:

https://tinyurl.com/TUVresearch

Video on the Capacities of the WM System:

https://youtu.be/XYBrCikUhn8

WM’s urls:

https://webtel.mobi/pc (Tablets / Laptops / Desktops)

https://webtel.mobi (Smart Phones)

https://webtel.mobi/wap (Pre-Smart Mobile Phones)

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/99883c25-51ca-4014-b403-6cbb5a10c67d

https://www.globenewswire.com/NewsRoom/AttachmentNg/47515174-a719-46d6-a73e-39c4b5b0afa0

https://www.globenewswire.com/NewsRoom/AttachmentNg/cb4b90d8-66b7-47ca-9105-157fbd276e95

The photo is also available at Newscom, www.newscom.com, and via AP PhotoExpress.